INVESTMENT

Cambodia,

The Center Of Southeast Asia.

Cambodia, a member of the "ASEAN" (Association of South-East Asian Nation).

Through an open foreign investment policy, various industries have entered the market,

and maintaining one of the highest economic growth rates in Southeast Asian countries.

About Cambodia

"The Kingdom of Cambodia" is a constitutional monarchy located in the southern part of the Indochina Peninsula in Southeast Asia.

After the Kingdom of Cambodia collapsed in 1970, the monarchy was abolished and shifted to the republican system. After the civil war, the monarchy was revived by the new constitution in 1993, and a new government was established by the general election.

It faces the Gulf of Thailand to the south, Thailand to the west, Laos to the north, and Vietnam to the east.

| Area | 181,000 km² | Major industry | Services

(42.3% of GDP)

Industry (32.7% of GDP) Agriculture (25.0% of GDP) (ADB Data, 2017) |

|---|---|---|---|

| Population | 16.3 million people | ||

| Capital | Phnom Penh | ||

| Ethnic group | 90% of the population is Cambodian (Khmer) | Nominal GDP | Approximately US$24.4billion

(IMF Data, 2018) |

| Official language | Khmer | ||

| Currency | US Dollars, Cambodian Riel

(KHR)

(USD 1 = KHR 4,064, as of 2nd March 2020) |

GDP per capita | US$1,504 (IMF Data, 2018) |

| Currency | US Dollars Riel

(KHR)

(USD 1 = KHR 4,064, as of 2nd March 2020) |

||

| Major industry | Services

(42.3% of GDP)、

Industry (32.7% of GDP)、 Agriculture (25.0% of GDP) (ADB Data, 2017) |

||

| Nominal GDP | Approximately US$24.4billion (IMF Data, 2018) | ||

| GDP per capita | US$1,504 (IMF Data, 2018) | ||

| Real GDP growth rate | 7.5% (World Bank Data, 2018) |

ASEAN

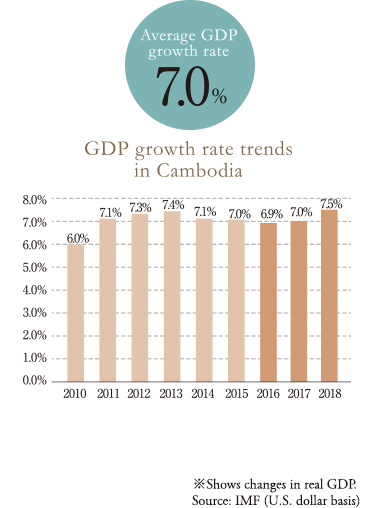

ASEAN is a regional organization for economic, social, political, security and cultural cooperation of the 10 Southeast Asian countries. Cambodia joined in 1999 and is headquartered in Jakarta, the capital city of Indonesia. ASEAN, which became a community in 2015, has shown high economic growth in recent years, and its potential has been attracting attention around the world, with its nominal GDP more than doubled over the last decade. The real GDP growth rate of each country has maintained stable growth since 2010, and the real GDP growth rate of the 10 ASEAN countries in 2018 was 5.2%. Since 2015, it has maintained a growth rate of about 5%.

Overwhelming growth potential driven by young power.

Cambodia is entering a period of high economic growth.

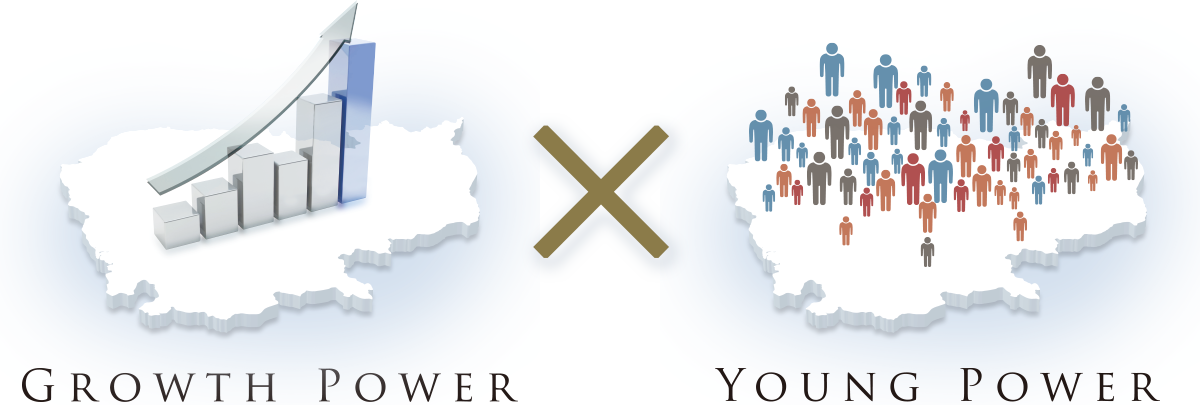

Cambodia is the No.1 in ASEAN countries with an average GDP growth rate of 7% in recent years.

And even now, that has continued to achieve strong economic growth driven by tourism and manufacturing.

It is expected that Foreign Direct Investment (FDI) mainly in the garment and real estate industries will continue to expand, and that the construction and tourism industries will grow as well. As a result, foreign investors have become very interested in Cambodia as an investment destination. In addition, the number of companies expanding into Cambodia as bases in Asia is increasing year by year.

Center of the ASEAN Economic Community Supply Chain

Cambodia, Vietnam, Laos, Thailand and Myanmar, which are referred to as the Mekong region countries, are attracting attention as targets for cross-border production division. With the completion of the AEC (ASEAN Economic Community) in 2015, which greatly promotes ASEAN's free trade, the "cross-border business environment" that transcends national borders is changing dramatically. Under these circumstances, Cambodia is aiming to build supply chains around Bangkok and Ho Chi Minh City by utilizing the "Southern Economic Corridor", an international arterial road, which is expected to serve as an industrial artery supporting the Mekong region economy.

The railway connecting Cambodia and Thailand opened.

The railway from Poipet (Cambodia) to Aranyaprathet (Thailand) located in the "Southern Economic Corridor" opened and a bridge that crosses the border completed as well. This is expected to improve the logistics environment.

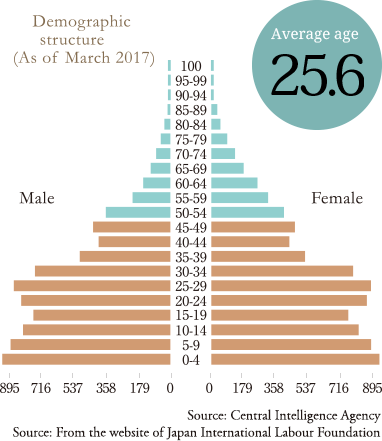

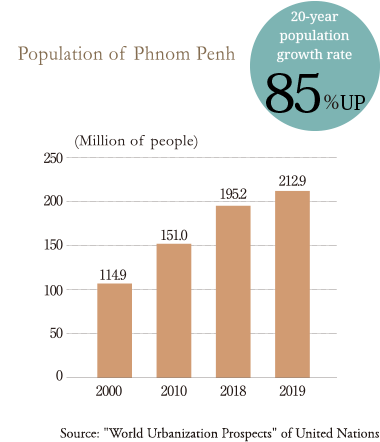

Proof of a growing country, overwhelming young energy and population growth

In Cambodia, there are many young people who are at the center of economic growth and the demographic chart is ideal. As a result , we can see that the market has growth potential and will be motivated to work in the next 20 years. The labour force is expected to continue to grow until 2070 as well as the total population until 2080. Consumer market is also expected to continue to expand over the next 60 years.

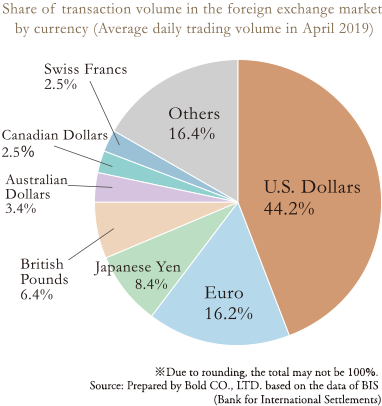

Real “dollarized” Cambodian economy with many investment benefits.

Cambodia is the only country in Southeast Asia where US dollar is in circulated as a substantially currency.

The Asian currency crisis began with the collapse of the Thai baht in 1991. The currencies of ASEAN countries such as Indonesia, Malaysia plunged, and the economies of these countries were severely damaged. The U.S. dollar is widely used in Cambodia. The U.S. dollar has a dominant share in the world in both cur rency transact ions and foreign exchange market transactions which has the advantage of reducing the risk of large fluctuations in foreign currency exchange rates. While each country has regulations such as restrictions on converting money into foreign currencies and restrictions on remittances abroad, and to do so requires complicated procedures, Cambodia has no restrictions on remittances so far. In addition, Cambodia's interest rate on time deposit is currently about 5% to 6.5% per annum※, making it extremely attractive from a financial perspective.

- Time deposit interest rate for 1 - 5 years of Phnom Penh Commercial Bank (Monthly distribution type) … 4.75% ~ 6.0% (As of January 2020)

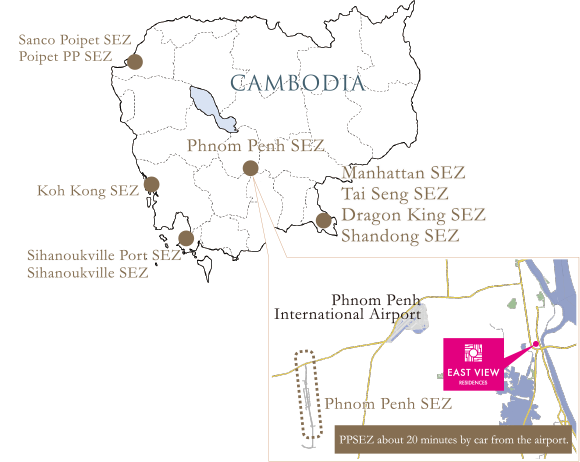

Special economic zone where investment incentives are taken.

In Cambodia, the Special Economic Zone (SEZ) has been set as a special zone for the development of the economic sector, where all industries are concentrated. Phnom Penh has the “Phnom Penh Special Economic Zone (PPSEZ)” which has the largest premises and number of tenants in Cambodia. Currently, there are about 100 companies from 15 countries in PPSEZ, of which 48 are Japanese companies. In addition to tax incentives, it is characterized by a well-developed infrastructure and a one-stop office for government office procedures for the Cambodian government such as customs clearance, various certifications and work permits. It is expected to advance further.

(As of February 2020)

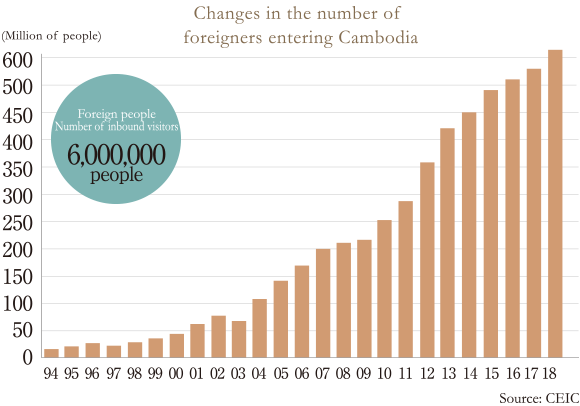

Demand for rent is rising as foreign companies expand their businesses.

In recent years, foreign companies have made remarkable inroad in Cambodia, and the number of foreigners entering the country has been increasing as well. In 2018, a record 6,000,000 people entered the country and at the same time demand for lease properties is increasing. Also, looking at the cumulative amount of direct investment (FDI) from overseas, a large amount of investment is recorded. Under the foreign direct investment legal system in Cambodia, foreign companies are treated as domestic corporations except for land ownership, and investment permits are automatically granted by filing a notification. The foreign investment ratio can be up to 100%, and the barriers to entry from overseas are lower than other ASEAN countries.

Large complex buildings under development in the center of Phnom Penh.

The 28-story Cambodian first high-rise building “Canadia Tower” opened in 2009 and the 39-story high-rise building “Vattanac Capital Tower” completed in 2014 stands across the road. There is a bar on the rooftop with a beautiful view. A complex with stores, offices and serviced apartments. In addition, "Exchange Square" completed in 2018 is a 26-story complex commercial building with a height of 117m consisting of shopping and office buildings. It is a building that houses luxury brand shops, movie theater and restaurants around the world. Meanwhile, Nagacorp, a Hong Kong-listed company that operates “NagaWorld”, the largest casino resort in Cambodia, announced a development plan. They are planning to develop five hotel towers, etc. as the third construction plan in addition to the already opened one and two. “NagaWorld Hotel and Entertainment COMPLEX” is expected to become the largest integrated resort in the Mekong area.

Vattanac Capital Tower and Canadia Tower

Exchange Square

NAGA2(Naga World Hotel2)

Currently, many large-scale urban developments are underway

Central area of Phnom Penh, which is less than 5% of the total area of the city itself.

Along with the rapid population increase in recent years, various urban development projects for the future such as development for the purpose of infrastructure development and elimination of housing shortages and realization of smart cities are underway.

It is expected that the capital function will expand in all directions in the future.

Phnom Penh Master Plan 2035

A new public transportation system will be introduced to reduce traffic congestion in the city, aiming to revitalize Phnom Penh's urban activities and the people-friendly environment.

ING City Development Plan

The largest satellite city project in Phnom Penh which is a sub-center development plan that the public and private sectors proceed by collaborating with each other.

Thai Boon Rong Twin Towers Project

A super high-rise twin tower under construction in central Phnom Penh. It will be 550m high with 113 floors and expected to be the highest in ASEAN when its complete.

Kandal State New Airport Development Plan

It will be built on 2,600 hectares of land in Takhmao. It is planned to be used mainly on large long-haul aircraft and to be equivalent in size to Siem Reap Airport.

Development of Garden City and National Stadium

Garden City, an enormous city with a size of 2,000 hectares. The main stadium will have a capacity of 60,000 people and is planned to be a national sports complex including a training stadium and tennis courts. Completion is scheduled in 2020.

Chroy Changvar District Development Plan

Residential areas, commercial facilities, skyscrapers, five-star hotels, schools, police stations, fire departments, hospitals, stadiums and parks will be built on more than 300 hectares of land.